They’ll face a 0.5% charge open WEBLOC files on the extra $1,000 they owe the IRS. If they file in June — two months after the tax deadline — they would owe $10. If you aren’t going to get your tax return finished by April 18, it’s best to file for an extension because the failure-to-file penalty is stiff. It is based on the lateness of a tax return as well as the size of unpaid taxes from the due date.

By using online tax software, you can file your return faster. Most tax software guides taxpayers through the process and provides additional free resources to explain confusing tax situations. After filing a valid tax extension, you have until mid-October of the same year to file your tax return. The IRS doesn’t have a timeline in place for filing past-due returns; you can file a prior year tax return at any time.

Zip

The special June 15 deadline also applies to members of the military on duty outside the U.S. and Puerto Rico who do not qualify for the longer combat zone extension. Affected taxpayers should attach a statement to their return explaining which of these situations apply. Combat zone extensions also give affected taxpayers more time for a variety of other tax-related actions, including contributing to an IRA. Various circumstances affect the exact length of the extension available to taxpayers. Details, including examples illustrating how these extensions are calculated, are in the Extensions of Deadlines section in Publication 3. In addition, victims of severe storms, flooding and landslides that began on Feb. 4 in Puerto Rico will have until June 15, 2022, to file and pay. The child care tax credit has reverted back to 2019 levels, the IRS announced in December.

- This is typically due to the PNG file using indexed colors and having an alpha palette rather than using a full alpha mask on the image itself.

- But being a tech enthusiast who uses multiple platforms daily, he also covers iOS, Mac, Social Media, and other topics in the wide spectrum of consumer technology.

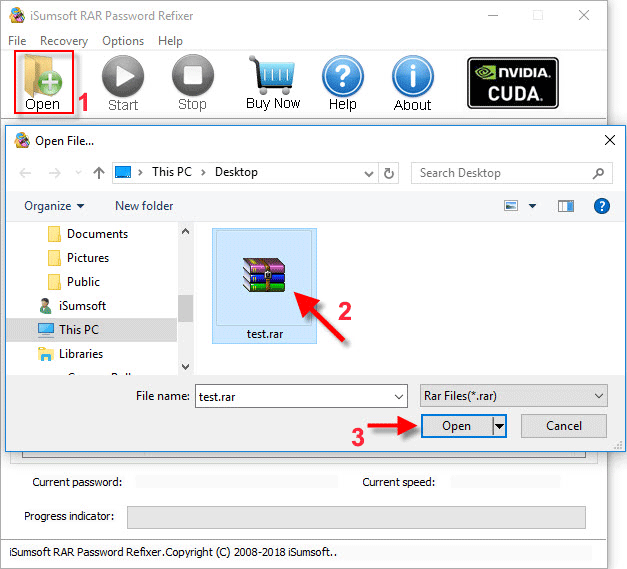

- The blog explains what a RAR file is, why we need to use the RAR file, and how to open it.

- Since it was introduced, the RAR file format quickly gained widespread recognition for its superiority compared to ZIP.

Contributions to a traditional IRA and Roth IRA are still due by the original tax deadline (usually April 15) unless you are contributing to a SEP-IRA. If you’re an independent contractor or otherwise self-employed, you can open and fund a SEP-IRA for the previous year by the extended deadline as long as you’ve filed an extension.

How to pay

Tuesday, April 18, 2023 is also the deadline for requesting an automatic six-month extension to file your 2022 tax return. Keep in mind that this extension does not apply to tax payments. You will still need to estimate what you owe and make a payment when you file for an extension in order to avoid penalties and interest. If you are granted an extension (which is automatic if you meet the requirements), your extended deadline to file your 2022 tax return will be October 16, 2023.

TIFF

According to court documents, he is expected to plead guilty to two misdemeanor tax charges as part of a plea deal. LLC owners only need to file Form 8832 if they want to change tax status. Schedule C reports income or loss from a business you operated or profession you practiced as a sole proprietor. Note that if your business is a sole proprietorship, you need to file attach Schedule C to your Form 1040 each year.